Looking for a life insurance policy that also offers some investment options? Then participating life insurance plans policy should be considered.

A participating life insurance policy is a type of policy that receives dividend payments or a monetary distribution of the earnings from the life insurance company. It is called participating because the life insurance policyholders are entitled to “participate” in the sharing of surplus earnings of the life insurance company.

When your whole life policy is considered participating, you are an owner of that company and will receive correspondence in regards to the company’s financial status and issues that require a vote.

You are able to vote by proxy, making decisions for the company. As a policy holder, you are able to participate in the way things are done at the company and voice how the company can be profitable. This is similar to how a stockholder of a company has the right to participate in the earnings of that company through growth and dividends.

Dividend Options

With this type of insurance, there are different ways for you to receive these policy dividends, also known as the insurance company’s profits. They are available to you in monthly payouts, also called “bonuses” or you can use the dividends to reduce the dollar amount of future premium payments on your life insurance policy.

This type of insurance also allows you to reinvest your dividends with the company and continue earning additional interest, like compound interest.

With this policy type, a portion of your insurance premium goes into mutual funds, and you can earn dividends on that money. This can be a great way to save for retirement or other long-term goals.

The dividend payment or “bonus” that is received has some tax advantages. Despite the terminology that is used, instead of being classified as form of dividends by the Internal Revenue Service, a life insurance dividend is actually considered, for tax purposes, to be a return of premiums or a return of payment paid.

Dividend payments are a share of surplus earnings. Premiums from a participating insurance policy contribute to the earnings of the company. This is why the IRS considers annual dividends, or the return of premium, as an overpayment, or more money than the life insurance company needs to operate.

Though dividends are technically a return of the surplus earnings, it is not rare for them to be paid. Most major life insurance companies make a dividend payment to their policy holders every year.

Life insurance companies are designed so that dividend payments are expected to be made to the policyholders throughout the future.

However, depending on the company and the market, these dividends or payments are not always guaranteed.

A whole life policy quote will start with an illustration, showing guaranteed benefits and nonguaranteed benefits. Typically the nonguaranteed benefits have been consistent for a long period of time. However, the life insurance company must play it safe by not overpromising. This is why they list both, guaranteed and nonguaranteed.

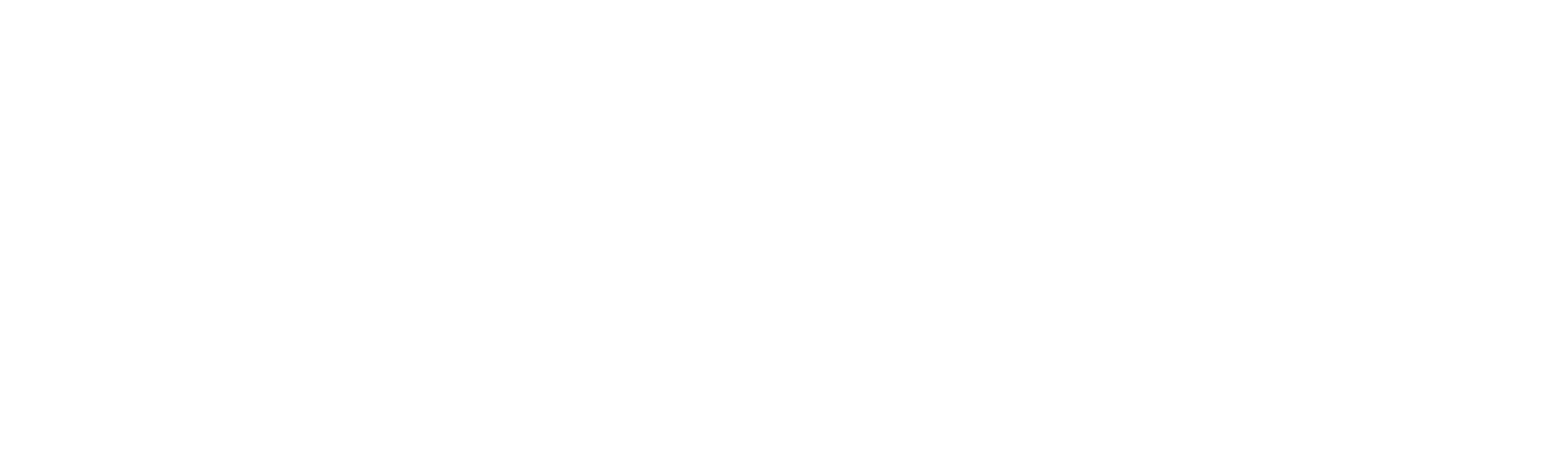

Mutual Company vs Publicly Traded Company

There are many life insurance products to choose from. Whole life insurance policies are usually the only type of policy that pays a dividend, and therefore is considered to be “participating”. This is true for an individual whole life insurance policy, and a whole life policy from a group plan through your employer.

Whole life insurance is considered a participating policy for a couple of reasons. The major reason is that in a mutual life insurance company the whole life policy owners are actually the owners of the company.

As owners of the company, they have a right to participate in the profitability of the company. This is similar to how the owner of a publicly-traded stock or company has the right to participate in the earnings of the public company through price growth and dividends.

Some life insurance companies are not mutual companies. They have other ownership structures, such as a publicly-traded corporations, known as a stock companies.

While the whole life insurance owners are not technically owners of the stock company, from tradition and for competitive purposes, the whole life policyholders are still paid a dividend when they buy a policy from a stock company.

A participating policy has advantages to the owner because of the profits of the insurance company, and therefore dividend payments have proven to be secure.

Cash Value Growth

Participating whole life insurance contracts provide for the buildup of something called cash value. This cash value of the policy is contractually guaranteed to be made available to the policy owner through a policy loan. This allows the policy owner to collateralize their policy and borrow money from the insurance company.

In other words, you can surrender part of the death benefit and withdraw equity from your policy. You get the surrendered portion back as the loan is repaid.

Owners have been growing their cash value and taking extra income from life insurance dividends for decades.

A whole life policy is a relatively safe investment with some tax advantages and has been a very high performer. Even planning to only get the guaranteed cash value (not the higher nonguaranteed), this investment can oftentimes be better than playing the market.

Not only are you getting lifelong coverage in the form of the death benefit, but you’re also making money along the way in the form of dividends.

Many folks, including myself, use this participating account as a sort of savings account. Though this financial vehicle has many more benefits than a typical savings.

This type of life insurance policy is sometimes known as a wealthy person’s Roth IRA. Once your Modified Adjusted Gross Income hits a certain point (i.e. $144,000 per year) you’re not eligible to contribute to a Roth IRA.

A loan that is taken from the insurance company against a policy in this manner will be subject to interest, and if this interest and future premiums are not paid, the contract may lapse, and the loan will then be considered a withdrawal and could be subject to being taxed.

If the life insurance plan isn’t well-managed, it could become a tax liability.

Pay the premiums, and don’t worry about the potential tax implications.

As long as the loan interest and premiums are paid according to the contract, the policy will not lapse and the owner of the policy can use the capital borrowed for whatever need or purpose intended.

Why A Participating Policy May be Best

For many people, a participating whole life insurance policy represents a very safe and stable investment tool (while the insurance provides valuable financial protection) as long as the policyholder can afford the whole life policy.

Many people who own whole life policies experience solid returns. Whole life insurance is widely considered in the industry to be one of the safest ways to invest.

The dividend rate depends on the market interest rates. When rates rise, the insurance company makes more money, therefore dividends rise.

The cash value in your life insurance policy is further protected by the total value of the life insurance company, as well as your state’s insurance regulations, up to a certain dollar amount.

When you factor in the safety, stability, and tax advantages, a participating policy is often the best choice for many people who are not best suited for term life insurance.

But remember to make sure that you budget for the whole life policy. It is more expensive than a term insurance policy.

Participation in the policy can also help reduce your taxes. Keep in mind, though rare, that dividends are not guaranteed, and the value of the mutual fund could go down.

How does Whole Life Insurance work?

First thing in getting a whole life policy or participating policy is finding a life insurance agent and becoming a policyholder. Then each year, quarter, or month, you will pay premiums to the policy. These premiums will go towards the life insurance policy’s death benefits as well as the cash value.

Once you have begun to make premium payments, loans can be taken out against the policy. The life insurance company requires you to use the cash value as collateral. Premium payments earn cash value. This is why you can’t take loans until you’ve made premium payments.

Then finally, the death benefit will be distributed to the beneficiaries once the policyholder passes away.

The only requirement to initiate a policy loan is to assign the policy to the insurance company for security. The insurance company will need to be contacted by either making a phone call or completing a simple online loan request form.

Policy loans can alter the death benefit of the policy and possibly the dividends that are paid or potential earned.

Pros and Cons of a Whole Life Policy

The policy loan benefits of a participating whole life insurance policy guarantees a source of value that can be borrowed and managed by an individual. When this is done in the right way, the positive cash flow can be used to create more value, wealth, and equity. It can also create the ability to increase policy premiums, and therefore allow you to repeat this cycle.

With this cycle of positive cash flow and properly managing the policy, the pros of having whole life insurance definitely outweigh the potential tax implications that could result from improperly managing the policy.

Below are the pros and cons of having a participating or whole life insurance policy:

Pros:

- It builds up accessible cash value over time

- Tax-deferred growth on cash value

- Access to tax-advantaged loans for any reason

- Potential to receive dividends

Cons:

- Premiums can be costly

- Withdrawals made can reduce the growth in the cash value

- Poor policy management can lead to costly tax liabilities

Choosing a Life Insurance Policy

When looking into the different life insurance policies, whether a participating (whole life) or nonparticipating policy (term life), remember to weigh the pros and cons of both.

What is required to get each one?

Can your budget afford one over the other?

The reasons why you are investing in life insurance.

Are you wanting a policy to cover expenses once you have passed, or a policy that you can have a cash value as well as a death benefit.

Whole life will most likely have higher premiums than term policies, but over time can be more beneficial due to dividends. Having the whole life policy or cash value policy, dividends will most likely increase as the policy’s cash value increases. The annual dividend will increase as you make the required premium payments.