Sometimes there is a difference in dwelling insurance and homeowners insurance, and sometimes there isn’t. Insurance companies do a great job of confusing us with their wording. I don’t believe they do it intentionally, but they do it nonetheless.

I will explain the differences you should be aware of regarding a homeowners policy and a dwelling policy.

WHAT IS A DWELLING

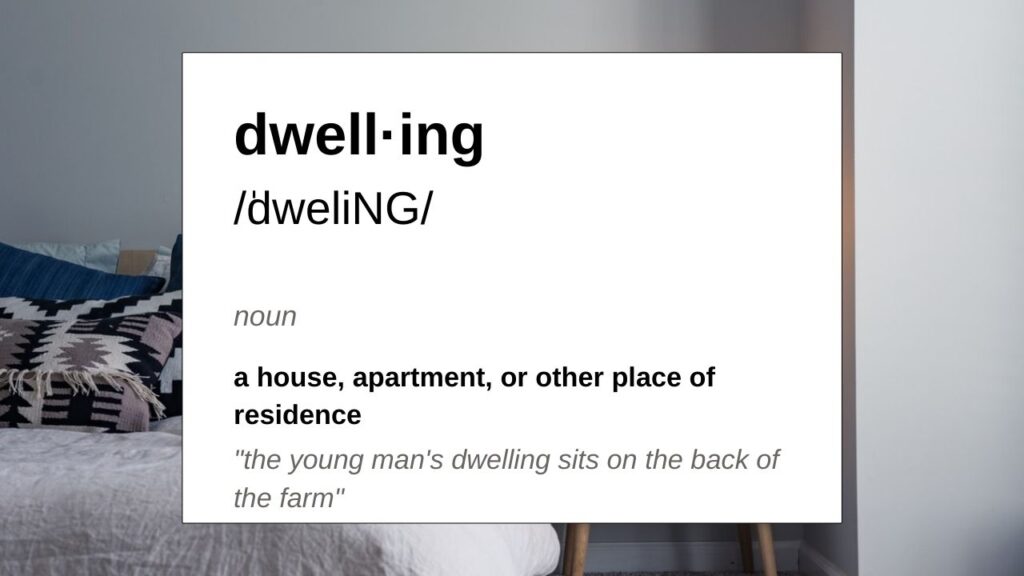

Let’s get something out of the way, even your homeowners insurance policy will list your home as a dwelling. You’ll notice that on your declarations page (the page that lists your coverage amounts). You’ll probably see Dwelling Coverage as the first coverage listed.

A dwelling is a shelter, or place of residence. It can be a home, an apartment, a condo, it can even be a mobile home or camper-type structure. We’ll refer to it as a place of residence.

Just because your homeowners policy lists Dwelling as a coverage does not mean you have a dwelling policy.

Let’s go over the different coverages in the two policies and determine which is best for your needs

HOMEOWNERS POLICY

Right off the bat this policy is for when the owner of the residence is residing in the residence. If the owner is not living in the home then the insurance company will not allow for the dwelling to be covered under a homeowners policy.

It can be a secondary home, or a seasonal home, but the occupant must be the owner.

You could almost say if the contents in the residence belong to the owner of the residence then it can be covered under a homeowners policy. Chances are even a secondary home will have contents that belong to the owner.

There are times where you might have a fully furnished rental property where you own some of the contents. Again, the owner is not living in the home. Therefore, it’s not eligible for a homeowners policy.

However, and we’ll dive into this a little bit later, a dwelling policy can be for an owner occupied residence. A dwelling policy does not have to be a rental property.

The coverages change when it’s not the owner residing in the home.

The very first difference you’ll see is in the personal property coverage. This is typically 50-75% of whatever the dwelling coverage is. It does NOT take away from the dwelling coverage limit. It is merely calculated by the dwelling amount.

If your dwelling (place of residence) is insured for $100,000, then you’ll see contents coverage of anywhere from $50,000 to maybe even $80,000. The difference in this percentage is based solely on the insurance company.

You will always find slight differences in coverage from insurance carrier to insurance carrier.

You’ll also notice your Other Structure coverage is a percentage of your Dwelling Coverage. Usually 10%, but again, this can vary, and it does not take away from the dwelling coverage.

It is important to remember that none of these additional coverages (contents, other structures coverage, loss of use, etc) take away from the dwelling coverage.

And on this type of policy, a true homeowners policy, you can have what many folks still refer to as Guaranteed Replacement Cost (GRC). Guaranteed replacement cost is almost non-existent. In place of GRC, insurance companies now offer extended dwelling coverage, usually in increments of an additional 25% or 50% of the dwelling coverage.

If your home is covered up to $100,000, and you have 50% extended dwelling coverage, then you actually have $150,000 to rebuild in the event it is needed.

Insurance companies refer to this endorsement differently, but it all means the same thing. I’ve seen it listed as additional replacement cost or extended replacement cost.

This endorsement is available to protect your financial investment in the event you have a total loss claim and the price to rebuild is higher than the Dwelling Coverage listed on your declarations page.

Hurricanes and other natural disasters affect lumber prices. Drastic fuel price increases affect lumber prices. Covid-19 and other pandemics affect lumber prices.

There are numerous things that can affect the local construction costs of your home on a whim. If your total loss claim happens during one of these extraordinary events then you’ll likely need the extended replacement cost protection. You will most likely not find this coverage on a dwelling policy.

Another coverage you won’t find on a dwelling policy, but will have the option of on a home insurance policy is replacement cost coverage on contents (personal items). Most insurance policies, even homeowners policies, start the contents coverage with actual cash value. Which means you do not have replacement cost on your contents. You can add that coverage, and your insurance agent might add it automatically. Some agents do. Some add it only if you request it.

Without replacement cost on contents then you most likely have what we call an HO-3 policy. With replacement cost on contents AND with extended dwelling coverage the policy is then referred to as an HO-5.

Replacement cost is basically the opposite of how full coverage auto insurance works. If you have a wreck, totaling a 10-year old Ford F150, you will receive a check for what that vehicle is worth. That is considered actual cash value. If you receive a check to buy a new Ford F150, that would be considered replacement cost. Actually, that would be considered guaranteed replacement cost, but I think you understand the point.

By the way, you’ll not find guaranteed replacement cost or even replacement cost on auto insurance. You might have it for the first year or 2 after purchasing a brand new vehicle, but that coverage goes away. Auto insurance is almost always actual cash value.

This is precisely how coverage works on your homeowners policy. Your dwelling coverage is replacement cost. You get enough money up to a certain dollar amount to replace with new. But not on contents unless you opt for that through an endorsement.

This is not an endorsement typically available on a dwelling policy. Contents on a homeowners policy are almost always replacement cost. Contents on a dwelling policy are almost always cash value.

The reason for this is because homeowners policies are open-peril policies. An open peril policy means the policy tells you what isn’t covered, because what is covered far outweighs what isn’t. It names what isn’t covered instead of what is. If it’s not listed as not being covered, then it’s covered.

A named peril policy tells you what is covered, because what isn’t covered far outweighs what is covered. It names what is covered instead of what’s not. If it’s not listed as covered then it’s not covered.

They condense the policy and we still don’t read it.

A covered peril in layman’s terms is a claim that’s covered by the policy.

A homeowners policy does not cover everything. Some things still need to be added, like sewer backups, flood insurance coverage, expensive items like high value guns or wedding rings need to be added specifically, and earthquake coverage.

Flood and earthquake coverages are sometimes required to be on a separate policy.

Those items can sometimes be added directly to standard homeowners insurance policies. I have not seen where you can add them to a dwelling fire policy.

Dwelling Fire or Hazard Insurance is the same thing as a dwelling policy or dwelling insurance.

Let’s get into the details of dwelling insurance.

DWELLING POLICY

A dwelling policy is typically reserved for investment property homes or rental properties. A residence where you have a financial interest in the structure but not necessarily in the personal belongings within the structure.

This type of policy is often referred to as a landlord policy. Although that’s not always true, it is the main focus of such policies.

You can still insure the structure of the home for replacement cost. You might not be able to add the additional replacement cost coverage of 25% or 50%.

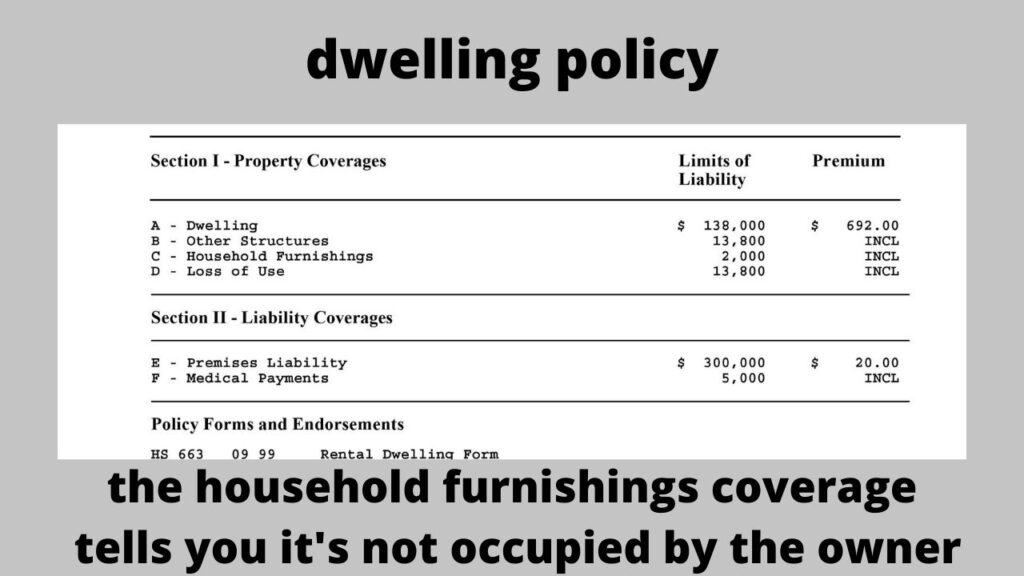

The personal property insurance on the policy is usually set at zero unless you ask for an amount. And if this is a true rental property policy, the insurance company will only approve a small amount of coverage, somewhere around $2500 or so to cover appliances or household furnishings. They are considered contents, not part of the dwelling.

This policy comes with Other Structures coverage just like the homeowners policy. It’s a percentage of the dwelling amount. Again, it does NOT take away from the dwelling coverage. It’s just based on a percentage of that amount.

There is a slight variation in these two policies with regards to Loss of Use coverage.

With homeowner’s insurance, in the event you’re not able to live in your home because of a covered peril claim, you have Additional Living Expense. This coverage pays for you to maintain your everyday living at a different location (rent, clothing, food, etc).

A dwelling policy has a coverage called Loss of Use. It’s based on the fair rental value of the property. It is to help with the loss of rental income while the home is being repaired due to a covered peril.

It is NOT coverage for the tenant.

In the event the place of residence is not livable, the tenant’s renters insurance could provide coverage for their additional living expenses incurred while their place of residence is unavailable due to a covered loss.

Do not confuse renter's insurance with rental property insurance. One is for the tenant, while the other is for the owner.

Both policies, and a homeowner’s insurance policy, offer personal liability coverage. With that coverage usually comes some sort of medical expense coverage. This too can be confusing. The medical coverage is not for the owner of the residence. And on renter’s insurance, it is not for the renter.

Medical coverage is there to protect the policy owner (tenant or residence owner) in the event someone else is injured on the property, because of the property, or even because of the policy owner. The same with the liability portion of the policy.

Liability and medical do not pay the policy owner, plain and simple.

The liability portion is there in case the policy owner is sued because of damage caused to others or to the property of others.

You can now see how there are numerous similarities in what dwelling insurance covers and what homeowners insurance covers. And even with what the renters policy covers.

However, there are some big differences as well. Especially when it comes to owner occupied dwelling policies.

Yes, not all dwelling policies are tenant occupied. We can have an owner occupied dwelling policy.

Why would you have an owner occupied policy? Because the price is less expensive.

Sometimes we just can’t afford to pay for all the bells and whistles that come with having a homeowner’s policy (HO-3 policy, or an HO-5 which is more expensive than the HO-3).

THEFT COVERAGE

There are coverages we give up in order to get a less expensive rate. One of those coverages is theft.

Homeowners insurance covers loss by theft. However, a dwelling policy does not. It covers damage from burglary and vandalism, but it does not pay to replace your stolen items.

It is important to note here that if a dwelling or residence covered on a dwelling policy is vacant for over 30 days there is no coverage for vandalism or malicious mischief.

Theft can be added to a dwelling policy, but it can be expensive. You’re also not likely to get more than $5k in coverage.

SEWER BACKUP

The backup of sewers and drains is another peril not included with dwelling insurance. Under a homeowners policy you can easily add coverage for the backup of sewers and drains. It is not as easy to add under a dwelling policy. Some insurance carriers don’t have that endorsement available for anything other than a true home policy.

I’ve dealt with more sewer backup claims than I have liability and medical expense claims. It’s a coverage I highly recommend. As is theft, but if I had to choose between the two, I’m going with sewer and drain coverage. I can take measures to prevent theft. I can’t do much about preventing the backup of sewer lines.

IN SUMMARY

It may sound like the dwelling policy isn’t ideal, but sometimes the price for a homeowners policy isn’t ideal. I’m not saying all homeowners policies are expensive. Sometimes they are, sometimes they aren’t.

There are so many factors in determining the price for insurance. So many! And all those factors help you determine which policy is best.

I’ll list a few of the factors, but even I, an insurance agent of 17 years, don’t know them all.

- cost to rebuild the dwelling, replacement cost and market value are not the same

- zip code, claims per zip code definitely play a part

- credit score, studies have shown higher scores make less claims

- distance from a fire station

- distance from a fire hydrant

- age of the dwelling

- updates made to the dwelling, roof and electrical for sure

- tenant occupied vs owner occupied

- claim history of the policy owner, this is usually the owner of the dwelling

- central heat vs wood heat

- exterior composition of the home (brick, wood/log, vinyl siding, stucco, etc)

We should take all of that into consideration, determine what coverages are most important to us, compare it to the price of the policy, and make a decision that won’t blindside us when we do have a claim.

One of the biggest misunderstandings as a homeowner, or as an adult, is how our insurance works.

If we know going in that we don’t have sewer and drain coverage then we don’t feel betrayed when we have that damage.

If we know we don’t have theft coverage then we won’t expect a claim check when our contents are stolen.

If we know we have a dwelling policy then we know we don’t have extended dwelling coverage when it’s time to rebuild during a pandemic.

We just need to do a little homework to determine what we have and what we need. Knowing dwelling insurance vs homeowners insurance is a good start.

Know that your contents coverage doesn’t take away from your dwelling coverage

Know your privacy fence is covered at cash value and not replacement cost

Know you have no coverage for varmint damage

Know if you have replacement cost on your contents or not

Know that medical expense coverage is not for you

All of this should be explained when you purchase a policy, but it’s not, and that’s why you’re searching the internet for answers. You’re paying for something. You want to know what to expect.

It’s time to determine what you need, or what you already have. You should be able to look through your policy, maybe even just your declarations page, and determine what type of hazard insurance policy you have. Is it a dwelling policy or a homeowners? Is it an HO-3 or an HO-5?

Do you need this type of policy? What’s important to you? What do you need?

You can now make that decision.