One of the primary components of establishing a life insurance policy is appointing at least one primary beneficiary to receive the death benefit following your passing. While this is highly recommended, it’s not mandatory that you appoint a specific person.

You should keep in mind that the typical reason people invest in a life insurance policy is to provide financial support to family members close to them.

However, there are times where your primary beneficiary is deceased, and your policy has not been updated.

If this is the case,

what happens if your policy no longer has any named beneficiaries?

Part of your estate

You may choose to apply your policy to your estate or other entity, like a trust, that isn’t a specific beneficiary like a named person.

After a life insurance policy has been decided upon, there are certain circumstances that may occur that ultimately affect or change the way you originally wanted the policy to be constructed.

One primary effect is if the beneficiary of your life insurance policy becomes deceased and you no longer have one assigned.

What happens to your policy if this occurs?

I will provide answers to both of these questions, including what occurs if you simply don’t name a beneficiary, if your appointed beneficiary passes away before you, and what you can do to prevent any potential issues from occurring in either case.

Having no beneficiary on your policy

When you’re applying for a life insurance policy, you’re often required, by the life insurance company, to name at least one beneficiary to ensure someone is there to receive the death benefit following your passing.

There are some cases in which the beneficiary is never named. Maybe a mistake was made on the application where you left the beneficiary name blank. Maybe you failed to get the beneficiary information to your life insurance agent.

Why you would buy a life insurance policy and not list a beneficiary is beyond me. The beneficiary is the sole purpose of a life insurance policy.

Regardless of the situation, there is a chance that something could occur and prevent a beneficiary from being appointed.

If you have no beneficiaries listed, the life insurance proceeds, following your passing, will most likely be paid to your estate after being decided through probate.

What is Probate

Probate is the legal process that occurs in which the court authenticates your policy and establishes the distribution of the assets left behind after your death. In this case, it should be determined that the payout benefits would be applied to the estate of the insured person to cover any outstanding debts.

Probate can, however, take some time and may charge substantial fees before your assets are provided to the estate. The policy’s death benefit can also become subject to state and federal taxes.

If no living relatives are located, the state could potentially take possession of any remaining assets.

Essentially, the benefits after your death should become part of the estate if there is no beneficiary listed on your policy. If there is no living trust, the estate of the insured must go through probate, in turn facing fees, taxes, and an extended amount of time needed to determine where assets should be distributed.

The best way to prevent any of these issues from happening is to ensure at least one beneficiary is named to your policy. This saves you from potentially losing some of your benefit amount or losing estate assets entirely.

Having a beneficiary listed on your life insurance policy may not always be required, or a mistake could occur preventing one from being named. Regardless of the situation, you should provide the necessary information to your life insurance agent so that someone can receive the payout with no impediment.

Sole beneficiary dies

When it comes to obtaining a life insurance policy, the process, though not always quick, isn’t very difficult. If you are the policy owner and the person insured on the policy, then you pay for the policy, and following your death, the death benefits automatically go to your named beneficiary. In most cases there are more than one beneficiary.

This becomes slightly less simple if you have only one named beneficiary and that beneficiary becomes a deceased person. However, the benefits don’t just disappear. If the primary beneficiary dies before you (the insured), the life insurance death benefit would then go to any secondary or contingent beneficiaries listed on the policy. If there are no named contingent beneficiaries then you will be dealing with the same process previously discussed, probate.

If the primary beneficiary is deceased and there are no other life insurance beneficiaries appointed, then the case will most likely be dealt with in probate court, where the life insurance benefits could be distributed to the estate of the insured or possibly lost completely to the state.

In this process, the proceeds will be subject to various charges and delays by the court. If everything goes well, though, the benefits could be paid to your estate and the distribution will be determined by the court or in accordance with your will, if you have one.

Always have contingent beneficiaries

Because of these circumstances, and to prevent issues that can occur through the probate process, it is always best to name multiple beneficiaries on your life insurance policy. Having a contingent beneficiary or multiple contingent beneficiaries is extremely helpful in preventing any issues if there is no longer a living primary beneficiary on your policy.

Secondary beneficiaries (same as contingent beneficiaries) are designated individuals who receive the financial benefit following your death in the case that the primary beneficiary is deceased or unable to receive the death proceeds. In other words, a “back up” to your first designated beneficiary.

Beneficiary rules: who gets what when

You may decide to name multiple primary beneficiaries, or co-beneficiaries, for your life insurance policy. Instead of only one person receiving the benefits as the designated beneficiary, these individuals can have equal shares of your death benefit or can receive a certain other percentage of the proceeds as determined by you.

In some cases, one of the beneficiaries may become deceased, affecting the equal split among your named primary beneficiaries. If this is the case, then the percentage of death benefit proceeds from the deceased beneficiary would be split evenly between the remaining beneficiaries.

Let’s consider an example. You designate your two children as your primary beneficiaries, with each getting 50% of the benefits following your death. However, if one of the children passes away before you, the other child would receive 100% of the benefit. If there was an equal share among three people and one died, then the other two would evenly split the proceeds of the deceased beneficiary, regardless of their current percentages.

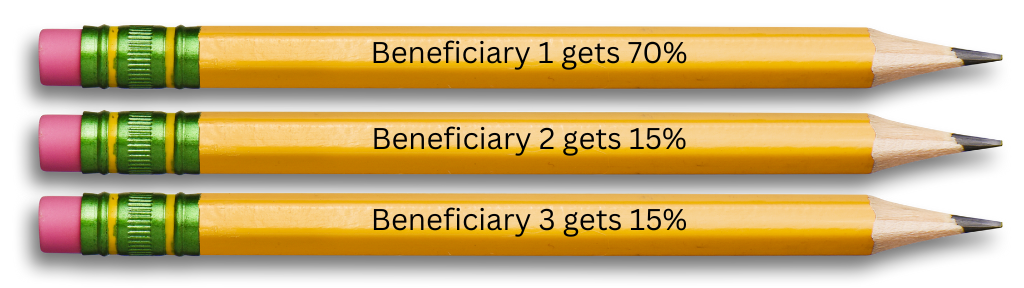

If you decide that you want to assign a certain percentage of the death benefit to each individual, you may do this too. You may decide that one designated beneficiary will receive 70% and two others receive 15% each. If one of those individuals died, then their percentage would be split even among the other two living beneficiaries. This is called “per capita”.

Let’s say Beneficiary 2 was no longer able to receive their 15%. Beneficiary 1 would then get 77.5% and Beneficiary 3 would get 22.5%

If you have any named contingent beneficiaries, they won’t receive any of the benefits in this case unless all of your named primary beneficiaries are deceased.

Beneficiary dies after you

There may be a chance that your beneficiary becomes deceased after you but before they receive the provided death benefits. If the life insurance claim has been submitted, the proceeds will be applied to the deceased primary beneficiary’s estate. Contingent beneficiaries will receive no proceeds as long as the life insurance claim was submitted prior to the death of the primary beneficiary.

The primary beneficiary would still receive the benefits because they were living after your time of death when the life insurance claim was submitted.

However, there is a catch. If the primary beneficiary didn’t have the opportunity or failed to file a life insurance claim (which notifies an insurance company of the insured person’s death) prior to their own passing, their estate will not receive the death benefit from the policy where they were listed as the beneficiary.

Rather than being applied to the estate of the deceased beneficiary, the death benefit proceeds would instead be provided to the contingent beneficiary. This contingent beneficiary would also need to file a claim with the death certificate of the insured person.

Although the chance is slim, you and your beneficiary could die at the same time. If this occurs, then the benefits following your death would go toward the primary beneficiary’s estate ONLY IF there were no named contingent beneficiary. IF there were a named contingent beneficiary, then the proceeds would go to that beneficiary.

List several beneficiaries

Regardless of the situation you may face, it’s clear that you should ensure none of these issues occur by naming multiple beneficiaries to your policy so that someone is available to receive your death benefits.

Leaving your proceeds and your estate to probate court will cause numerous fees, possible higher estate taxes, and delays that make it difficult to provide for your loved ones after you have passed.

If you need any assistance in determining your beneficiaries, you can speak with your life insurance agent, a financial advisor or an attorney to decide who should receive your policy benefits and how you should list those individuals.

Another way to avoid the problems that occur with the death of a beneficiary is to assign a trust as your life insurance beneficiary. However, a trust needs to be updated periodically as well. Nothing here should be left alone. A contingency plan for after you’re gone is worth keeping updated.